- THE ULTIMATE GUIDE TO TACKLE REJECTION

It can be distressing when your health insurance claims get rejected, and you end up paying for the treatment costs from your pocket. It can also provoke a sense of panic and uncertainty about your healthcare coverage. But Understanding the reasons behind these claim denials will empower you to navigate the complexities of health insurance more effectively and helps you avoid similar situations in the future.

Insurers need precise details to process claims, and any discrepancies can result in delays or denials. Our clients frequently face these rejections, and despite our efforts to seek reimbursement, we often cannot resolve the issues due to errors on the insured's part.

In spite of numerous reminders and requests, our clients neglect to mention or fail to disclose existing health conditions as serious as diabetes, asthma, COPD, and others.

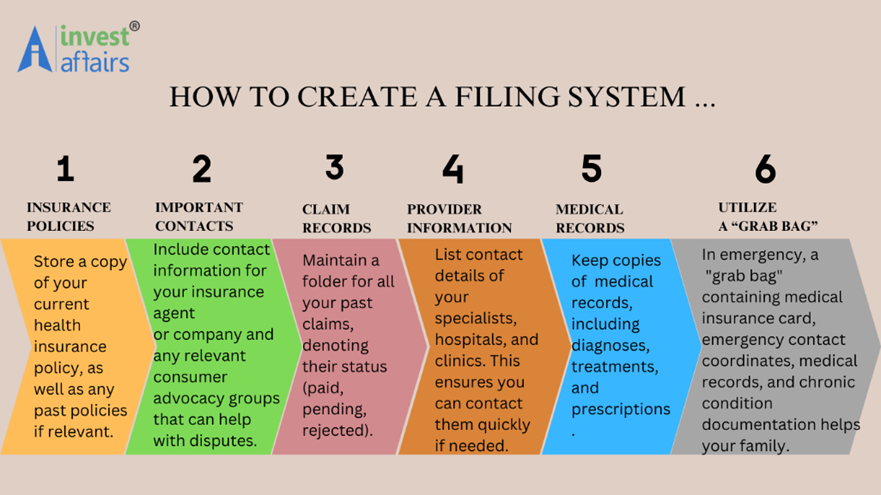

Furthermore, it is crucial for the policyholder, whether they are purchasing or renewing their insurance, to retain copies of all documents and medical records submitted to the insurance agent. While policy copies and renewal slips are often sent via email or in PDF format, it is essential to maintain a dedicated medical insurance file for the convenience of family members and caregivers.

So, first things first. Once you have bought or renewed a policy, meticulous record-keeping is key to ensuring that all necessary information is easily accessible when needed, particularly in times of illness or emergency.

At our firm Investaffairs we have a dedicated team and system where we save all the necessary documents/details and files of our clients who have purchased insurance through us. Our team makes it a point to send reminders well ahead of the renewal time , extending every bit of support when it comes to renewals, top ups and the point in question “Claims”.

At Investaffairs, we have a dedicated team and system in place to securely store all essential documents, details, and files for our clients who have purchased insurance with us. Our team is proactive in sending reminders well in advance of renewal dates and is committed to providing comprehensive support for renewals, top-ups, and, importantly, claims.

Here’s a more elaborate guide on why and how to organize your medical insurance documents effectively:

IMPORTANCE OF RETAINING DOCUMENTS

CLAIMS PROCESSING:

When filing claims, having all relevant documentation at hand—such as policy numbers, previous claims, and submitted medical records—can expedite the processing time. This helps ensure you receive prompt reimbursement or payment for medical services.

UNDERSTANDING COVERAGE:

Insurance policies can be complex, with different levels of coverage, exclusions, and terms. Retaining a copy of your policy and any rider documents not only helps you understand your rights and privileges but also assists in navigating potential disputes.

TRACKING MEDICAL HISTORY:

Keeping detailed records of medical treatments, prescriptions, and doctor visits can aid healthcare providers in delivering more informed care. This is particularly important for ongoing or chronic conditions.

SIMPLIFYING CAREGIVER ACCESS:

In times of illness, you may not be capable of communicating your insurance details or medical history. By storing this information in a centralized location, you can ensure that family members or caregivers can easily access it when necessary.

HOW TO ORGANIZE YOUR MEDICAL INSURANCE FILE

You may always choose to organize your files/ documents digitally or in a docket, according to your convenience but, at Investaffairs, we always insist on considering a combination of both. Digital copies provide ease of accessibility, while physical copies can be crucial if technology fails or certain situations where paperwork is prioritized and paper copies are required.

After going through the harrowing medical ordeal, the last thing you want is your health insurance claim being rejected. However, this is a possibility, especially if you do not fill the right information, submit the wrong documents, etc. Below we address a few scenarios where you will face claim rejection. Let us take a look at some of the biggest reasons for claim rejections and what you can do about them.

Let us take a look at these two case studies first:

Case Study 1: Our Client Mr. Rajesh, a 45-year-old salaried individual, purchased a comprehensive health insurance policy to safeguard his family’s health. The policy provided a sum insured of ₹Y lakh and covered hospitalization expenses, diagnostic tests, and post-hospitalization treatment. He diligently paid his premiums (for a period of four years) and believed he was adequately insured

Incident

In December 2024, Rajesh was diagnosed with a severe gastrointestinal disorder requiring immediate surgery. He was hospitalized for 10 days, and the total medical bill amounted to ₹ X lakh. Confident about his policy, he submitted a claim to his insurer.

Despite having valid coverage, Rajesh's claim was rejected. The insurer cited the following reasons for rejection:

- Pre-existing Condition Clause: The insurer alleged that Rajesh's condition was a pre-existing illness and he was also diabetic which he did not disclose at the time of purchasing the policy

- Delayed Intimation: The hospital failed to notify the insurer within the stipulated 24-hour window.

- Inadequate Documentation: Certain diagnostic test reports and prescription slips were missing.

The rejection left our client in financial distress, as he had to deplete his savings to pay the medical bills. It also caused emotional stress, as he felt betrayed by the insurer despite being a loyal policyholder.

However, Rajesh approached the Insurance Ombudsman for grievance redressal. Key findings during the resolution process:

- Medical History: Rajesh had no prior diagnosis of gastrointestinal issues, disproving the insurer’s claim of a pre-existing condition. Nevertheless, he had not disclosed that he was diabetic.

- Documentation: Rajesh provided the missing documents during the ombudsman's review process.

- Intimation Clause: The ombudsman noted that the hospital delayed the intimation.

- Non-Disclosure Clause: Undisclosed PED worked in favour of the insurer.

Our client is still fighting the case stating that the broker never insisted on a blood work while renewing the claim. Therefore, he was himself not aware of his spiked sugar levels.

Case Study 2 : Mrs. Sayantani Dhar, a 50 year old housewife, held a health insurance policy with a sum insured of ₹Y lakh. The policy covered hospitalization expenses, diagnostic tests, and day-care treatments.

Incident

In June 2024, Mrs. Dhar experienced severe pain in chest, dizziness and twitching/numbness in nerves . Suspecting a cardiac issue, her husband rushed her to a nearby hospital. Her husband insisted on admitting her as a precautionary measure as the doctor suggested a series of tests to evaluate her condition. The doctors conducted an ECG, blood tests, and cardiac enzyme analysis and other tests to rule out a heart attack. Thankfully, the results were negative, and Mrs. Dhar was discharged the following day with advice to manage stress and monitor her condition.

The total bill, including admission charges, diagnostic tests, and doctor’s fees, amounted to X amount. Her husband submitted the claim to his insurer.

The insurer rejects the claim. Why ?

- Hospitalization Not Required: The insurer argued that Mrs. Dhar’s condition could have been managed through outpatient consultations and did not warrant hospitalization

- Diagnostic Purpose Clause: The policy excluded claims for admissions done solely for diagnostic purposes without subsequent treatment.

The couple was shocked and felt the rejection was unfair, as the hospitalization was done based on medical advice.

To fight the rejection:

- Obtained Doctor’s Certification: Her doctor provided a written statement explaining the necessity of hospitalization due to the risk of a cardiac event

- Referred to Policy Terms: Our client highlighted that the policy covered emergency admissions and diagnostics in cases of suspected life-threatening conditions

Our client escalated the issue to the Insurance Ombudsman, who reviewed the case and ruled in her favour. The ombudsman emphasized that denying a claim in genuine emergency cases undermines the policyholder’s rights. The insurer was directed to settle the claim.

LET US EXPLORE THE REASONS WHY YOUR HEALTH INSURANCE CLAIM CAN GET REJECTED

LAPSED POLICY :

When you raise a claim, the insurer will first check whether your policy is active. If you have failed to renew the policy on time and it has expired, the insurer is not liable to cover your medical expenses. Every policy has a validity period, and you must renew it by paying a premium before the due date. If you miss the due date, there’s a grace period, which varies between insurers; if you also miss the grace period, the policy will be considered null and void.

INCORRECT INFORMATION:

One of the primary reasons for claim denials is incorrect or wrong information on the claim form. While filling up the form, make sure you enter the correct details with regard to the policy number, name, age, details about the illness, etc. Any incorrect/missing information will lead to the rejection of your claim.

FILING CLAIM DURING THE WAITING PERIOD:

The waiting period is the time you have to wait to avail of the coverage benefits. Most insurance plans have waiting periods for pre-existing conditions, specific ailments, maternity coverage, etc. If you have raised a claim within the waiting period, your claim is likely to get rejected.

HIDING INFORMATION ABOUT PRE-EXISTING DISEASES:

If you have any pre-existing conditions like diabetes, hypertension, or heart ailment, you must honestly disclose them while buying health insurance. If your claim is related to a pre-existing condition that was not disclosed, it will lead to claim rejection. The insurer estimates the premium based on your health profile and risks; non-disclosure of information will misrepresent your health profile.

DELAY IN FILING THE CLAIM:

Most insurance companies have a timeframe within which one must notify the insurer and file the claim. The insurer has the right to deny your claim if you fail to submit the claim within the specified timeline. Timely filing of claims is crucial for the smooth processing of claims.

INSUFFICIENT DOCUMENTATION:

Insurance companies require certain documents to check the authenticity of claims, which you must submit at the time of settling claims. If some documents are missing or incorrect, it can lead to denial of claims. So, double-check the documents before submitting the claim.

EXHAUSTION OF SUM INSURED:

If the sum insured has already been exhausted in previous claims, you are not eligible to file any more claims during the same policy year. Similarly, if the claim amount exceeds the sum insured, the insurer will reimburse only up to the sum insured. The payment of the excess amount must be borne by you.

OUT OF COVERAGE:

If the claim is for a treatment not covered by your policy, the insurer will not compensate for the costs incurred. It is, therefore, imperative to carefully read the inclusions and exclusions before buying a policy and also prior to raising a claim. Remember, every policy has certain exclusions and limitations.

FALSE INFORMATION:

If the insurer suspects you have provided false information, your claim can get rejected on the grounds of fraud.

PRE-AUTHORISATION:

Some treatments or procedures require prior approval or pre-authorisation from the insurance company. If the insured has gone ahead with the treatment without taking approval, the claim may be rejected.

BLACKLISTED HOSPITALS:

Insurers may deny claims if treatment is received at hospitals excluded from their coverage. Check your insurer’s list of excluded hospitals before admission.

MEDICAL TEST

Undergoing regular medical tests can help you stay informed about your health, and accordingly, customize your insurance plan to get maximum coverage. A medical test can be considered as a proof of the policyholder’s existing medical conditions, and it can significantly reduce the chances of the claim getting rejected.

Whenever you encounter a rejection, you can approach the insurer's grievance cell. Our experts will guide you on this as well lest you face any difficulty in processing the claim. If you don’t receive a response in 30 days or it is unsatisfactory, you can make a representation with the Regulator.

How to Avoid Claim Rejections

Here are some ways to avoid claim rejection in health insurance

Renew your policy on time for continuity in coverage. Insurers generally send reminders at least 15 days prior to the policy’s expiry date. So, as soon as you get the reminder, pay the premium for renewal of the policy.

If it’s a cashless claim, you need not worry about the payment because the insurer will settle it directly with the hospital on the day of discharge. However, if it’s a reimbursement claim, you must submit the claim form along with the required documents within 15 days after discharge from the hospital. The timeline can differ from insurer to insurer.

Read the policy document carefully to understand the terms and conditions of coverage.

Inform the insurer on time. If it’s an emergency hospitalisation, notify the insurer within 24-48 hours of getting hospitalised; in case of a planned hospitalisation, you must inform the insurer at least 2-3 days in advance.

When a claim gets rejected, it can get stressful. So, to avoid claim denials, you must be aware of the steps mentioned above and reduce out-of-pocket expenses.

Insurance companies offer a variety of health plans tailored for individuals, families, parents, seniors, and women. There are plans to cover critical illnesses and the much dreaded big C. If you can take a moment from your busy schedule to go through this information (file:///C:/Users/Aparna%20Bose/Downloads/ican-brochure.pdf), then you will understand its importance. Especially if you know of a family member who has fought this battle. Cancer is a monster which not only eats your body, but it also feeds on your soul, your mental strength and depletes the life savings of you and your family.

Cancer insurance can serve as a valuable supplementary option alongside your current health insurance policy, especially if you have a family history that indicates an average risk of developing cancer. By opting for a cancer-specific insurance plan, you may benefit from lower premiums compared to traditional health insurance, while still addressing your financial needs.

If you currently lack health insurance, consider purchasing a cancer insurance plan based on your financial situation and the associated risks of a cancer diagnosis. However, it’s essential to understand that having both a cancer insurance plan and a comprehensive health insurance policy does not guarantee double coverage for cancer and non-cancerous diseases. Most cancer insurance plans include a “coordination of benefits” clause, which typically excludes coverage for benefits already provided by other health insurance policies. Therefore, carefully review the inclusions and exclusions of your cancer insurance plan before making a decision.

It's crucial to buy adequate cover for yourself and your family, as it can significantly impact your financial security. Your coverage should reflect your health, lifestyle, location, and more. For example, living in a Tier-1 city often means higher treatment costs than in a Tier-2 city. Age and health also influence the appropriate policy amount. Our brokers offer excellent plans, or you can discuss your needs with your agents. Read more here.

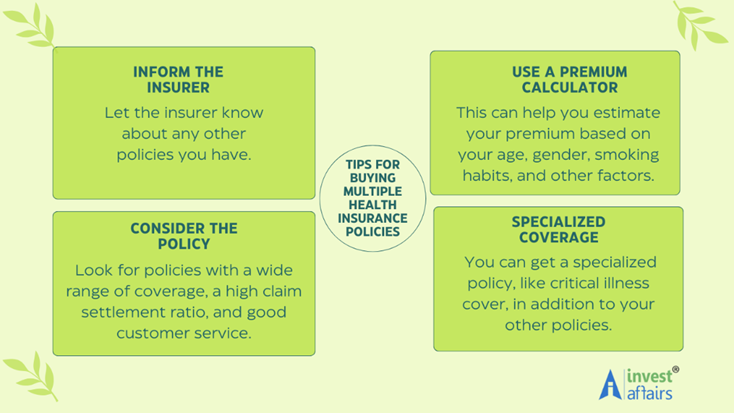

CAN WE PURCHASE MORE THAN ONE POLICY?

Yes, you can purchase more than one medical insurance policy. In fact, it can be a good idea for people who have a disease, as insurance companies may consider them high-risk and offer limited coverage.

Here are some benefits of having multiple health insurance policies:

- Financial safety net: Multiple policies can provide a financial safety net in case of a claim rejection or if you need to use medical treatment more than once.

- Lower premiums: Buying multiple policies can lower your overall premium costs.

When you have multiple policies, you can use them for a single claim, but you can't claim the same expenses from more than one insurer. For example, if your claim with Company A doesn't cover the full bill, you can file a claim with Company B for the remaining balance.

Benefits of Health Insurance

- Accidents, sickness, and other health ailments are never pre-planned. So, during a medical emergency, the rising medical costs can be a burden on the patient or his family. However, a comprehensive health insurance plan can help you meet your medical expenses and avoid financial woes. Here are some of the benefits of having a health insurance policy:

- You will receive cashless treatment for admissible ailments if you are in a network hospital and thus save yourself from taking money out of your account for the treatment.

- Getting a health insurance policy early in your life can offer a plethora of benefits at lower premiums.

- The health insurance plan can help you avail high cost treatments and skip paying the expensive bills from your own pocket.

- Having health insurance can sometimes also cover preventive health measures like health checkups and screenings.

- Cumulative Bonus (CB) is another added advantage if you don’t claim your insurance for some amount of time whereby your coverage amount is increased. In addition to )CB_, if you are a long time policyholder, you might also be eligible for a long term policy discount. You can talk to your insurance provider for more details on this.

- Health insurance is a great tax saving instrument too. With a comprehensive health insurance policy, you can save up to Rs. 75,000 in tax annually, under section 80D with health insurance plans. A win-win situation indeed!

P.S. Kindly regard this write-up as work in progress. We at Investaffairs work in tandem with NJ Broker, our insurance partner.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts